Investors

While real world events impact investors’ capital, that capital also drives change in the real world. Investing in climate solutions is the single biggest business opportunity of our generation.

Übermorgen Ventures is one of Europe’s first and most active early-stage venture capital firms focused solely on climate. Our investment approach is characterized by broad diversification across different industries, geographies, and business models. We aim to offer our investors attractive long-term equity returns alongside measurable climate impact.

Our expertise.

We are a team of entrepreneurs with deep investment, market, science, and legal expertise. Together we have built 21 companies, invested in 130+ startups and successfully exited 18 of them. We pair our climate know-how with a hands-on, disciplined, entrepreneurial mindset. That blend enables us to support our founders from day all the way to a successful exit.

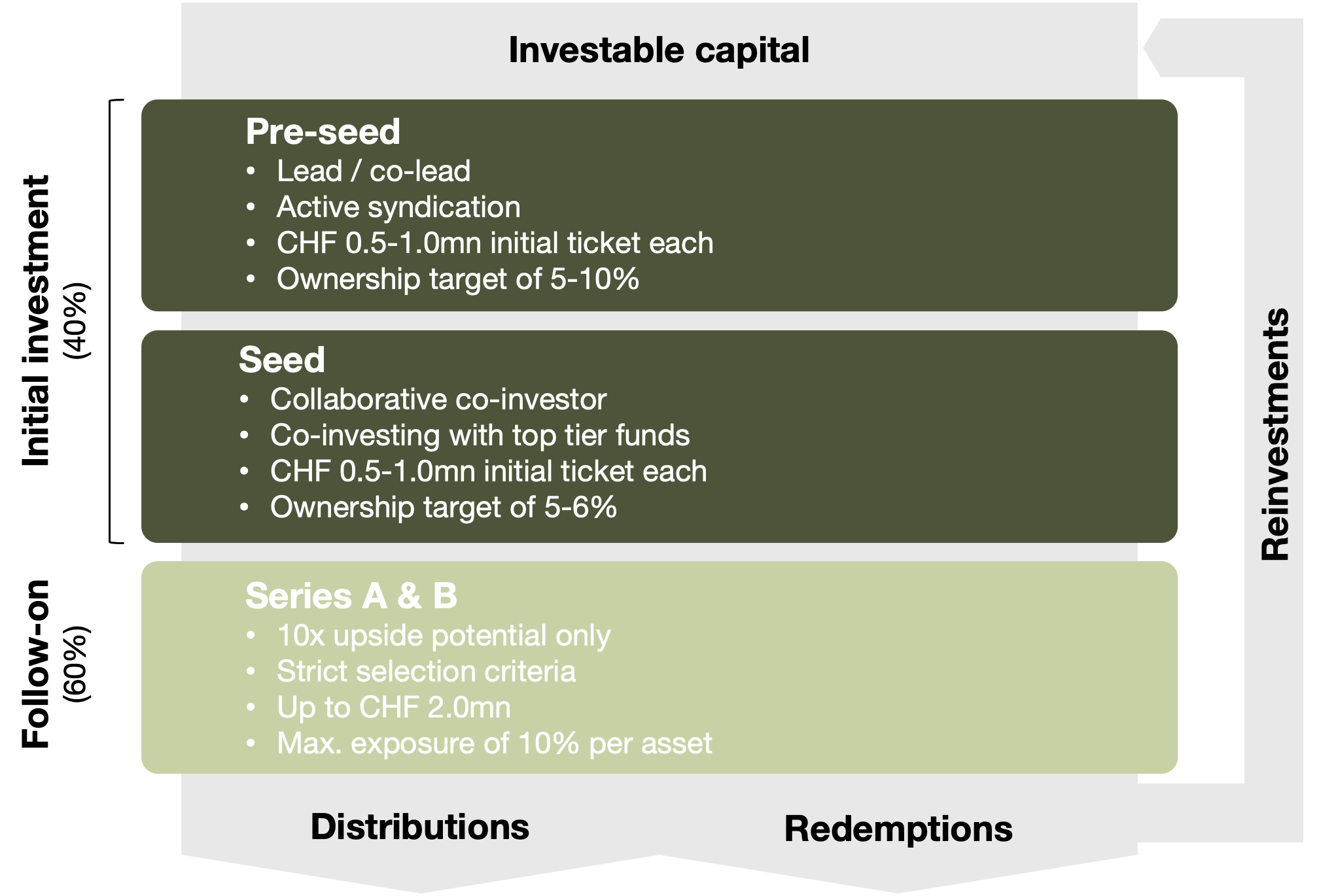

Investment strategy.

-

What you see is what you get: unlike other funds that start from zero, you gain full portfolio transparency and immediate exposure from day one—jumping right into the value-creation stage of the J-curve.

-

Our portfolio is deliberately broad: spanning industries, business models, and European geographies. With a continuous, long-term investment horizon, we stay positioned through every phase of the economic cycle.

-

We aim at maximizing value by flexibly engaging with our portfolio firms and staying involved for as long as it makes sense, while partially reinvesting proceeds into new companies and the winners in our existing portfolio.

-

Our semi-liquid structure gives full control over divestment schedules to our LPs: we provide liquidity via redemptions after a 6-year lock-up period.

-

We rigorously assess the climate innovation potential of a startup before we invest and track and report our impact on a regular basis.

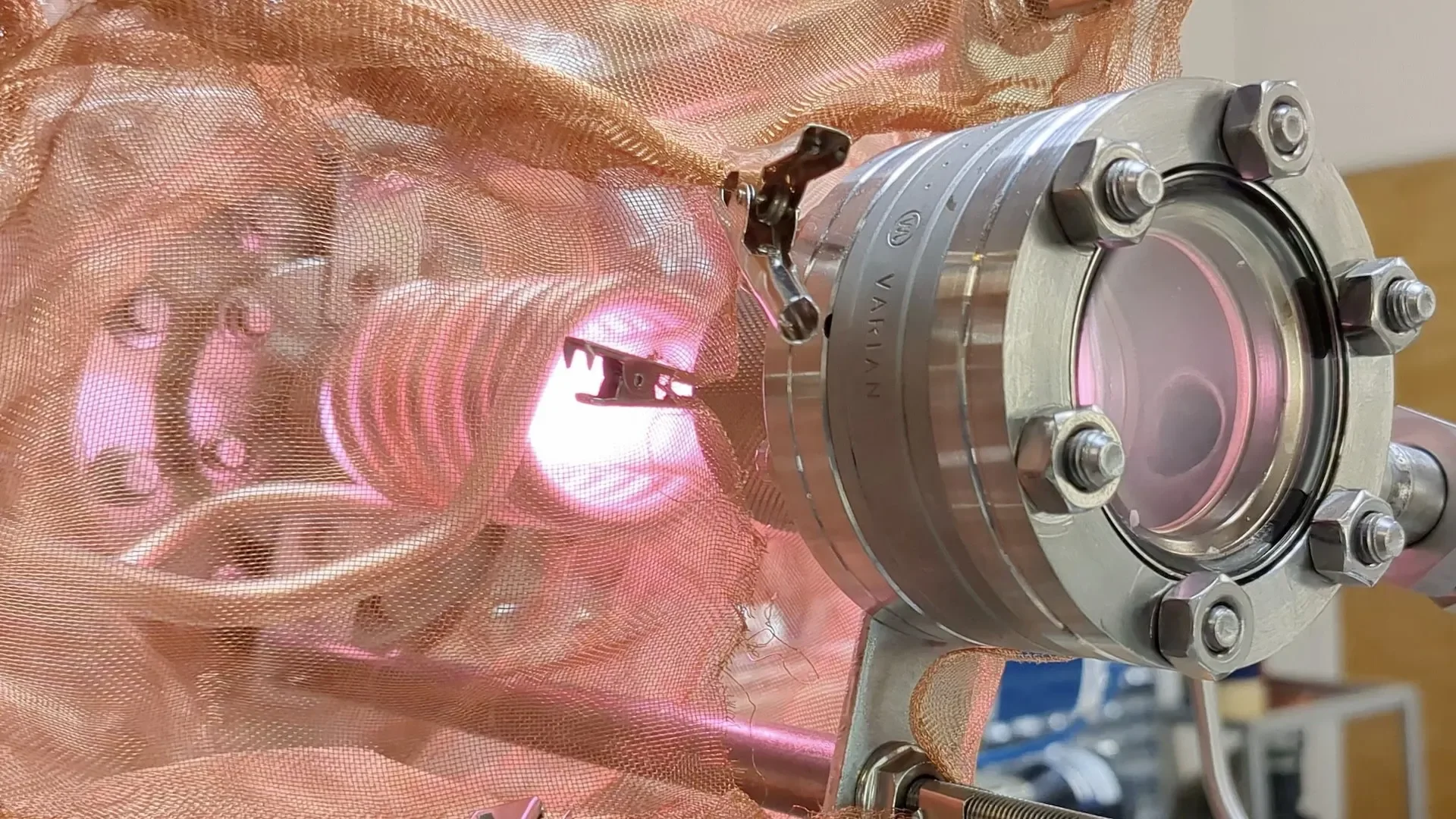

We have invested in category leaders already and industry-shaping innovators across the energy management, computing and AI, nuclear fusion, novel materials, construction, and more.

Want to find out more?

Find out more and download our factsheet, request further investor documents for qualified investors, or reach out to our investor relations team.

Disclaimer.

This is a marketing communication. The information made available on this website is provided for informational purposes only and does not constitute or form part of any offer, invitation, inducement, advice, recommendation or solicitation to subscribe for or to acquire any interests in the Übermorgen Ventures Investment Fund (the “fund”). The materials on this website do not take into account the particular needs of any user and the website does not provide specific investment advice to any individual viewing the content of the website.

All investors should consider the investment objectives, risks, charges and expenses of the fund carefully before making a final investment decision. Please refer to the private placement memorandum and key information document of the fund for further information. Investors are urged to carefully read such documents in their entirety before investing.

An investment in the fund therefore entails a significant degree of risk, including, but not limited to, those risks described below, and, therefore, should be undertaken only by investors capable of evaluating the risks of the fund and bearing such risks, and who are in a position to commit funds for a considerable period of time.

Past performance and profitability: past performance does not predict future returns. There can be no assurance the fund will achieve its objectives or avoid significant losses.

Illiquidity and realisation of investments: the fund’s investments are illiquid and long-term, with no guarantee of realising these investments at favourable prices or implementing a successful exit strategy.

Risks in private equity and venture capital: the care in selecting investments does not guarantee finding suitable companies or their expected development, as such investments inherently carry high risks, including insolvency. The fund’s influence on the management of financed companies is limited, and delays in finding investment opportunities might result in unattractive terms for invested capital.

Sector-specific investments risks: investments (including early-stage investments) in certain technology secotors may be particularly risky due to rapid market changes, regulatory requirements, and potential negative impacts of new legislation or regulation. These sectors’ volatility may adversely affect the fund’s returns.

Investments in private companies: the fund’s investment in private companies presents additional risks due to their susceptibility to economic downturns, less public information availability, reliance on key personnel, and potential irregular accounting practices, which could result in losses for the fund.

The information above outlines certain risk factors of the fund, however, it is qualified in its entirety by the fund’s constituent documents and the complete list of risk factors set out therein and available upon request at investors@uebermorgen.vc. Any capitalised terms above which are not otherwise defined have the meaning given to them in the fund’s private placement memorandum.